Thursday, February 20, 2014

Tuesday, January 21, 2014

MONITORING OF MARKS

HI ALL,

Please check that the tabulation of marks are correct to date.

Those with R please redo the worksheet as they have either incomplete statement or wrong mathematical notation used.

All the materials must be filed in the following order:

.1 Notes

.2 Assignments

.3 Quizzes (assessments)

according to topic:

.A Financial Matters (Practical Application) - 2 assignments

.B Probability - 4 assignments

.C Statistics - 1 assignment with 1 due in Week 5

.E Geometric Constructions - 1 assignment due in Week 6

.F Equation of Circle - 1 assignment in Week 7

.G Plane Geometry - 1 assignment in Week 7

Should you need assistance in understanding the concept do approach me or your friends.

Key:

Marks highlighted in blue indicate excellent to outstanding quality

cell in Pink indicates no submission or work not received (reasons not stated)

R indicates work has to be resubmitted due to quality or concept

A+ outstanding work submitted

LEVEL TEST

please note the following:

TOPICS covered for Level Test (EM & AM)

ensure that you are familiar with the topics to be tested. As secondary 4 is a critical year for assessment you are expected to review past topics covered in secondary 3 and lower secondary. The regular short class quizzes administered by your ST help to review the past and new knowledge and skills.

APPARATUS and EQUIPMENTS

Ensure that you have the approved scientific calculator (with the SST sticker)

- familiarise yourself with the functions such as the STATs function

Geometrical sets (compass, protractor, rules, eraser, decent pencil)

Please check that the tabulation of marks are correct to date.

Those with R please redo the worksheet as they have either incomplete statement or wrong mathematical notation used.

All the materials must be filed in the following order:

.1 Notes

.2 Assignments

.3 Quizzes (assessments)

according to topic:

.A Financial Matters (Practical Application) - 2 assignments

.B Probability - 4 assignments

.C Statistics - 1 assignment with 1 due in Week 5

.E Geometric Constructions - 1 assignment due in Week 6

.F Equation of Circle - 1 assignment in Week 7

.G Plane Geometry - 1 assignment in Week 7

Should you need assistance in understanding the concept do approach me or your friends.

Key:

Marks highlighted in blue indicate excellent to outstanding quality

cell in Pink indicates no submission or work not received (reasons not stated)

R indicates work has to be resubmitted due to quality or concept

A+ outstanding work submitted

LEVEL TEST

please note the following:

TOPICS covered for Level Test (EM & AM)

ensure that you are familiar with the topics to be tested. As secondary 4 is a critical year for assessment you are expected to review past topics covered in secondary 3 and lower secondary. The regular short class quizzes administered by your ST help to review the past and new knowledge and skills.

APPARATUS and EQUIPMENTS

Ensure that you have the approved scientific calculator (with the SST sticker)

- familiarise yourself with the functions such as the STATs function

Geometrical sets (compass, protractor, rules, eraser, decent pencil)

Monday, January 20, 2014

On Your Own - For Practice, Revision & Acceleration

You would have received an email invite (at your SST account) to sign up as a member of this online portal.

For your information, the Khan Academy comes with a vast collection of video clips on almost all topics (& sub-topics) in our curriculum. It also comes with quizzes that auto-mark and therefore enables you to check your understanding and mastery of the skills. This will complement what we do in class.

Note that the quizzes are largely Multiple Choice Questions or require you to enter numerical values only. You must also keep in mind the importance of writing the working/ steps in a logical manner. Hence, practices on papers should continue.

This is a useful resource that you can use for practice, revision... and for those of you who are would like to accelerate your learning, you may pace yourself accordingly - e.g. pick a topic that would be taught this year and start to learn on your own.

Note of caution: Always check your textbook on the presentation of the mathematical notation.

For example, at secondary level, 4 x 7 should not be written as 4.7 (by inserting a dot between 4 and 7).

You may also invite your parent to sign up an account and invite him/ her as your coach.

Set-up Guide for Parent:

1. Parent to set up an account

2. Student to invite Parent as Coach

3. Parent to login to monitor child's progress

4. Parent can also assign tasks for child to attempt

Wednesday, January 15, 2014

01 TAXATION, GST, CESS

Last updated on 13 August 2013

|

Tuesday, January 14, 2014

02 STATISTICS: Class Limits, Boundaries And Intervals

READING 1:

Class Limits, Boundaries And Intervals

Class Limits

Class limits are the smallest and largest observations (data, events etc) in each class. Therefore, each class has two limits: a lower and upper.

Example:

| Class | Frequency |

| 200 – 299 | 12 |

| 300 – 399 | 19 |

| 400 – 499 | 6 |

| 500 – 599 | 2 |

| 600 – 699 | 11 |

| 700 – 799 | 7 |

| 800 – 899 | 3 |

| Total Frequency | 60 |

Using the frequency table above, what are the lower and upper class limits for the first three classes?

For the first class, 200 – 299

The lower class limit is 200

The upper class limit is 299

For the second class, 300 – 399

The lower class limit is 300

The upper class limit is 399

For the third class, 400 – 499

The lower class limit is 400

The upper class limit is 499

Class Boundaries

Class Boundaries are the midpoints between the upper class limit of a class and the lower class limit of the next class in the sequence. Therefore, each class has an upper and lower class boundary.

Example:

| Class | Frequency |

| 200 – 299 | 12 |

| 300 – 399 | 19 |

| 400 – 499 | 6 |

| 500 – 599 | 2 |

| 600 – 699 | 11 |

| 700 – 799 | 7 |

| 800 – 899 | 3 |

| Total Frequency | 60 |

Using the frequency table above, determine the class boundaries of the first three classes.

For the first class, 200 – 299

The lower class boundary is the midpoint between 199 and 200, that is 199.5

The upper class boundary is the midpoint between 299 and 300, that is 299.5

For the second class, 300 – 399

The lower class boundary is the midpoint between 299 and 300, that is 299.5

The upper class boundary is the midpoint between 399 and 400, that is 399.5

For the third class, 400 – 499

The lower class boundary is the midpoint between 399 and 400, that is 399.5

The upper class boundary is the midpoint between 499 and 500, that is 499.5

Class Intervals

Class interval is the difference between the upper and lower class boundaries of any class.

Example:

| Class | Frequency |

| 200 – 299 | 12 |

| 300 – 399 | 19 |

| 400 – 499 | 6 |

| 500 – 599 | 2 |

| 600 – 699 | 11 |

| 700 – 799 | 7 |

| 800 – 899 | 3 |

| Total Frequency | 60 |

Using the table above, determine the class intervals for the first class.

For the first class, 200 – 299

The class interval = Upper class boundary – lower class boundary

Upper class boundary = 299.5

Lower class boundary = 199.5

Therefore, the class interval = 299.5 – 199.5 = 100

===========================================================

Class Interval

Comment on the following:

.1 What are the key differences between class limits, class boundaries and class intervals ?

.2 How will these differences impact the accuracy of the analysis?

===========================================================

READING 2:

class interval

Class Interval

Definition of Class Interval

While arranging large amount of data (in statistics), they are grouped into different classes to get an idea of the distribution, and the range of such class of data is called the Class Interval.

More about Class Interval

- Class intervals are generally equal in width and are mutually exclusive.

- The ends of a class interval are called class limits, and the middle of an interval is called a class mark.

- Class interval is generally used to draw histogram.

Example of Class Interval

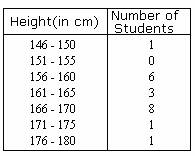

- In the table above, heights of 20 students of a class are divided into classes with the size of each class interval being 5.

Solved Example on Class Interval

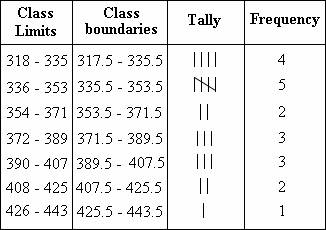

Plant scientists developed different varieties of corns that have a rich content of lysine which is a nutritious animal feed. A group of chicks were given this food to test the quality. Weight gains (in grams) of these chicks after 21 days are as recorded: 380, 321, 366, 356, 349, 337, 399, 384, 410, 329, 350, 340, 324, 396, 412, 420, 382, 318, 344, 438. By constructing a frequency distribution table for 7 classes, find the class interval in which the weight increase is maximum.

Choices:

A. 426 - 443

B. 335 - 351

C. 318 - 438

D. 336 - 353

Correct Answer: D

Solution:

Step 1: Range of the data = higher value - lower value = 438 - 318 = 120

Step 2: Width = Range/number of classes = 120/7 = 17.14 ˜ 18

[Round to the higher value.]

Step 3: Construct the class limits (weight gains) with width 18, so that the least and the highest values are included.

Step 4: The class limits, boundaries, tally marks and the frequency for each class (number of tally marks) are shown in the table.

Step 5:Step 6: The class interval in which the weight increase maximum is 336 - 353. [Frequency is more for the class 336 - 353.]

Comment on the following:

.1 What are the key differences between class limits, class boundaries and class intervals ?

.2 How will these differences impact the accuracy of the analysis?

Monday, January 13, 2014

HDB InfoWEB: Median Resale Prices by Town and Flat Type : Buying a Resale Flat

Authentic Learning

The Housing Development Board (HDB) in Singapore uses the median price of HDB flats in various estates as a gauge of property prices in that area.

Why is the median price used as a central tendency value instead of mean or modal values? Access the website link below to find out how statisticians decide on the most appropriate central tendency value in real life. What sort of critical thinking skills do statisticians use?

HDB InfoWEB: Median Resale Prices by Town and Flat Type : Buying a Resale Flat

Tuesday, January 7, 2014

01 EXCHANGE RATE

What is CURRENCY EXCHANGE?

Maybe you've traveled to Mexico or Canada, and exchanged your American dollars for pesos or Canadian dollars. Or, perhaps you've traveled from England to Japan and exchanged your English pounds for yen. If so, you have experienced exchange rates in action. But, do you understand how they work?

You've probably heard the financial reporter on the nightly news say something like, "The dollar fell against the yen today." But, do you know what that means?

In this article, we'll tell you what exchange rates are and explain some of the factors that can affect the value of currency in countries around the world.source: http://money.howstuffworks.com/exchange-rate.htm

01 HIRE PURCHASE

What is hire purchases?

Hire purchase is a method of buying goods in which payment of purchase price is spread over a specific period of payment of an initial deposit followed by regular installments.

Hire purchase is a method of buying goods in which payment of purchase price is spread over a specific period of payment of an initial deposit followed by regular installments.

The deposit is called down payment.

Items that can be bought through hire purchases:

- Mobile devices

- Motor vehicles

- Computers

- Industrial machinery

- Equipment

- Furniture

- You do not need large amounts of cash to buy an asset

- The seller is more willing to allow you to make small regular payments as the assets stay in his/her ownership until you have made all the repayments

- As the repayment amounts are fixed, it is easier to budget or manage your cash flow

- Higher purchase loans are handy for businesses who are buying assets that do not qualify for fixed assets loans

- You end up paying more for the asset than you would if you paid outright. On top of that, you would have to service the interest on the loan

- The seller can take back the asset if you fail to make a scheduled repayment. This is true even if you have already paid a substantial amount for the asset

|

| source: http://www.infinitifinancialservicesuk.com |

Subscribe to:

Posts (Atom)